Retirement Planning Built Around You

Financial Planning & Investment Services for Retirement

We offer fiduciary, fee-only financial planning and investment management for people approaching or living in retirement.

That means:

No commissions

No product sales

No hidden incentives

Advice that is always aligned with your best interests

Our role is to help you make a thoughtful, confident decisions about your money and support you as your life and priorities evolve.

WHO WE WORK WITH

We do our best work with individuals and couples who are approaching retirement and want clarity, confidence, and peace of mind as they step into this next chapter.

Our clients often have done many of the right things over the years, but still find themselves wondering whether everything will actually work together the way they hope. They’re looking for reassurance, thoughtful guidance, and a plan that helps them feel steady - not overwhelmed - as retirement gets closer.

We work especially well with people who:

Want a clear understanding of where they stand and what’s possible

Prefer simplicity over complexity and don’t want to manage every detail themselves

Value working with a fiduciary, fee-only advisor who puts their interests first

Appreciate having an experienced partner to help guide decisions as life evolves

Want their financial plan to support not just retirement, but the people and experiences that matter most.

Our clients value the confidence and direction that we provide as well as having the freedom to focus on living their lives while knowing their finances are being handled thoughtfully.

If that sounds like you, we’d be glad to start with a conversation

Our Client Journey

Retirement planning works best when it’s approached as a process, not a one-time transaction. Our work together follows a clear, intentional path designed to bring clarity first, then action, and ongoing support over time

eNGAGE

Get answers. Gain Clarity. Make a confident plan.

We begin every client relationship with our Retirement Assessment, a focused, planning phase designed to create clarity, alignment, and a clear path forward.

Financial planning isn’t a one-time event - it’s an ongoing, collaborative process. As your fiduciary advisor, we take the time to deeply understand both your life and your finances, so we can help you align your money with what matters most.

We start by creating a clear, comprehensive view of your financial life. This brings together all the moving parts in one place, including income and expenses, investments, taxes, insurance, and retirement income sources.

From there, we help you clarify your retirement goals and define what your best retirement actually looks like. Together, we evaluate your options, identify gaps and opportunities, and develop personalized strategies to support the next chapter of your life.

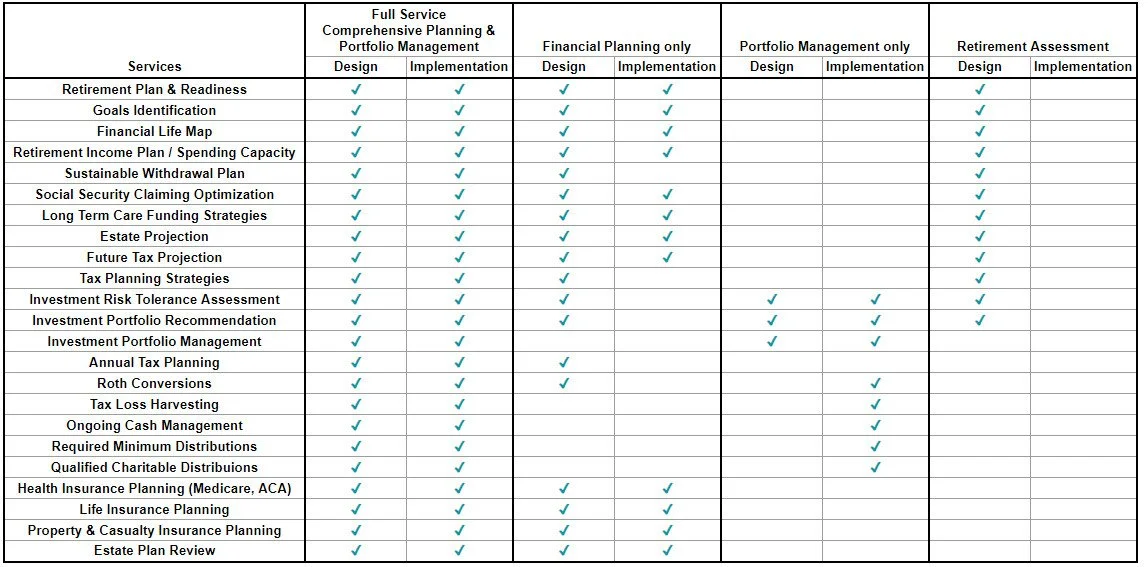

What the Retirement Assessment Includes

Intro Call

A 30-minute conversation to learn about your circumstances, vision for retirement, and whether working together is a good fit.

Data Gathering

We collect a comprehensive set of information, including work and retirement timelines, financial details, investment portfolios, and risk tolerance.

Retirement Assessment Meeting One

We review your information and have an in-depth discussion about where you stand today, where you want to go, and what matters most to you.

Retirement Assessment Meeting Two

We walk through your financial plan, including findings, recommendations, and strategies that guide your next steps.

This phase is designed to answer the big questions and give you confidence, not just numbers.

IMPLEMENT

Financial Planning & Coordination

Implementation may include:

Cash flow and investment alignment

Account transfers and consolidations

Development of a sustainable withdrawal strategy

Tax strategy coordination

Estate and insurance reviews as needed

Our goal is to simplify complexity and ensure everything is working together as intended.

Investment Management

Our investment management services are always personalized - because your portfolio should reflect your goals, values, and timeline.

We believe the best investment strategies are built as part of a comprehensive financial plan, so your money works in sync with the rest of your life.

As your fiduciary advisor, we:

Determine an appropriate asset allocation based on your goals and risk tolerance

Recommend a diversified portfolio that balances growth, income, and stability

Handle implementation, ongoing monitoring, and rebalancing

Adjust your strategy as your needs and priorities evolve

Whether you’re planning for retirement or already retired, your investment approach is designed to adapt, not stay static.

Your Financial Life, Organized in One Place

Clients have 24/7 access to a secure financial planning portal through RightCapital - your personal financial website.

Everything is organized in one place, including:

Net worth

Goals

Retirement income sources

Expenses

Taxes

Investments

Estate plan

Insurance

Secure document storage

This give you a clear, up-to-date view of your entire financial picture anytime you want it.

MAINTAIN

Consistent guidance, built into your year.

As part of our ongoing relationship, we provide service and support across all areas of retirement planning.

Ongoing Planning & Support Includes

Income & Distribution Planning

Cash and portfolio distribution management

Portfolio withdrawal strategy reviews

Stable income source alternatives

Pension payout analysis

Social Security claiming strategies

Tax & Account Strategy

Tax planning and coordination

Roth conversion analysis

Required minimum distribution planning

Qualified charitable distributions

Investment Oversight

Ongoing portfolio monitoring

Rebalancing of investment portfolios

Protection & Legacy Planning

Estate plan and beneficiary reviews

Life insurance needs analysis

Long-term care planning and funding strategies

Lifestyle & Aging Considerations

Medicare plan options

Home equity strategies

Proactive aging planning

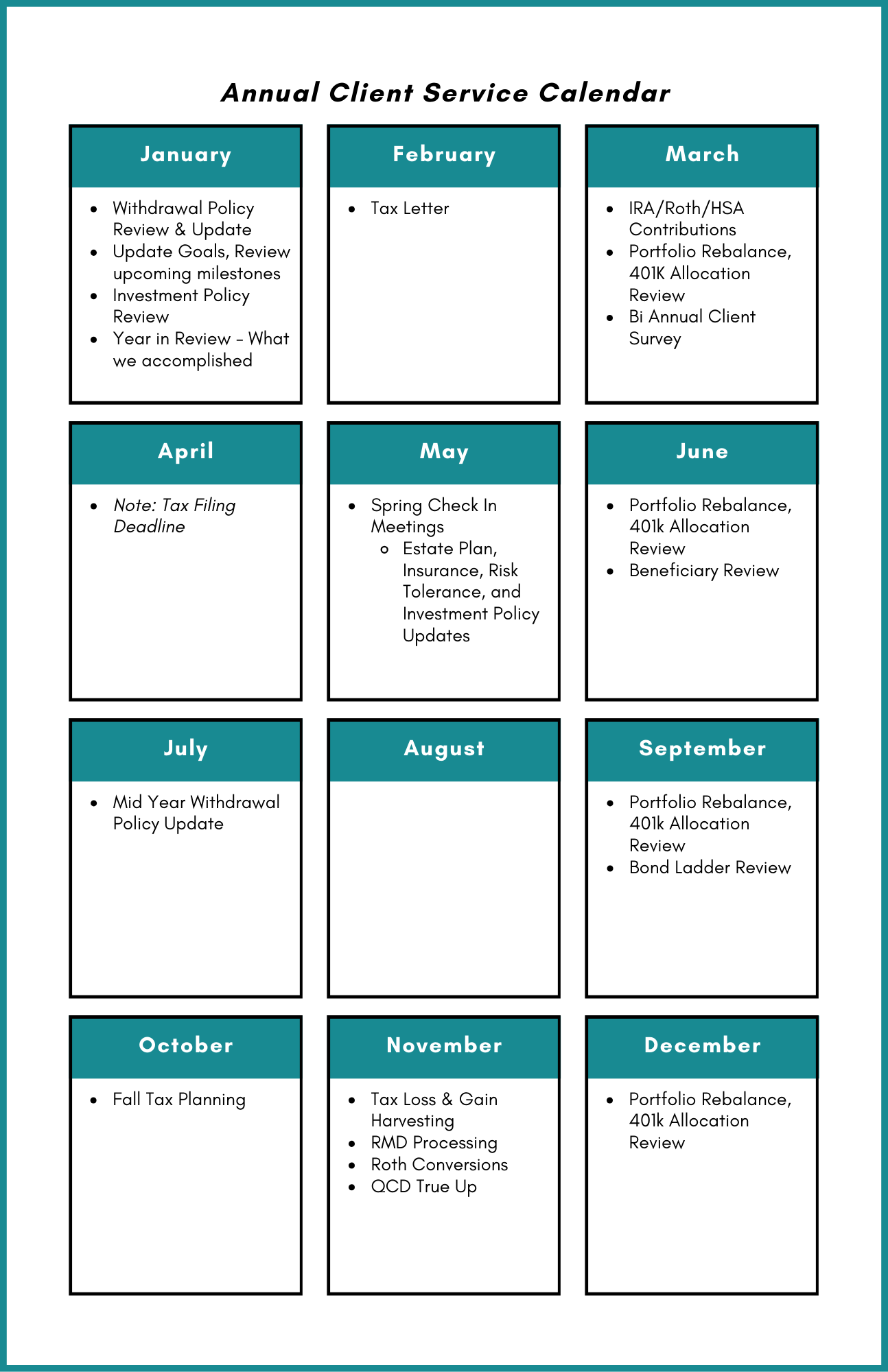

This work is guided by our annal service calendar, ensuring planning happens before deadlines - not after.

How to Get Started

Every client relationship begins with a conversation.

If you’d like clarity around where you stand and a confident plan for what comes next, the first step is a free intro call.